:max_bytes(150000):strip_icc()/what-is-the-greece-debt-crisis-3305525_color-b9e14a23152147fb85ff77f92c48a21f.jpg)

Ancient Greek Government Structure - Source www.animalia-life.club

Our team of experts has analyzed the budget and identified the key takeaways. In this guide, we will provide you with a comprehensive overview of the budget, including its key goals, spending priorities, and potential impact on the Greek economy.

Key Differences

| Year | Budget (in billions of euros) | Key Focus |

|---|---|---|

| 2023 | 195.2 | Economic recovery from the COVID-19 pandemic |

| 2024 | 198.2 | Continued economic growth and fiscal consolidation |

| 2025 | 201.2 | Investment in infrastructure, education, and healthcare |

Main Article Topics

FAQ

This section addresses frequently asked questions regarding the comprehensive 2025 Greek Government Budget. Each question is answered concisely, providing clear and accurate information.

Question 1: What are the key objectives of the 2025 Greek Government Budget?

The 2025 Greek Government Budget prioritizes stimulating economic growth, reducing unemployment, and improving the quality of life for Greek citizens. It allocates significant funds to infrastructure projects, education, healthcare, and social welfare programs.

Economies | Free Full-Text | Economic Role of Government Budget - Source www.mdpi.com

Question 2: How does the budget address Greece's debt obligations?

The budget includes measures to reduce Greece's debt-to-GDP ratio through a combination of fiscal consolidation and economic growth. It targets a gradual reduction in the deficit and a sustainable path for debt repayment.

Question 3: What is the impact of the budget on the environment?

The budget incorporates environmental sustainability as a key priority. It allocates funds for renewable energy projects, energy efficiency initiatives, and the protection of natural resources.

Question 4: How does the budget support the most vulnerable in society?

The budget includes measures to strengthen social protection programs, expand access to healthcare, and provide support for low-income households. It aims to reduce poverty, inequality, and social exclusion.

Question 5: What are the mechanisms in place to ensure transparency and accountability in the budget execution?

The budget implementation is subject to strict monitoring and reporting frameworks. Independent oversight bodies and parliamentary scrutiny ensure transparency, accountability, and compliance with fiscal discipline.

Question 6: How will the progress of the budget be assessed and revised if necessary?

Regular evaluations and reviews will be conducted to assess the effectiveness of the budget in achieving its objectives. Based on these assessments, adjustments may be made to the budget allocation and implementation strategies to ensure ongoing relevance and alignment with the evolving economic and social landscape.

In summary, the 2025 Greek Government Budget is a comprehensive and forward-looking plan that seeks to address the challenges and opportunities facing Greece. It provides a roadmap for economic growth, social progress, and fiscal sustainability while placing a strong emphasis on environmental protection and social justice.

Transition to the next article section: For a deeper analysis of the 2025 Greek Government Budget, please refer to the full report available on the Ministry of Finance website.

Tips

The 2025 Greek Government Budget: A Comprehensive Guide provides valuable insights into the nation's financial priorities. By understanding the budget, businesses and individuals can make informed decisions and stay abreast of economic trends. Here are some tips to effectively navigate the budget:

Tip 1: Review Key Expenditure Areas

Examine the budget's allocation to various sectors, such as education, healthcare, and infrastructure. Understanding these priorities can help businesses identify potential opportunities and anticipate market shifts.

Tip 2: Analyze Revenue Projections

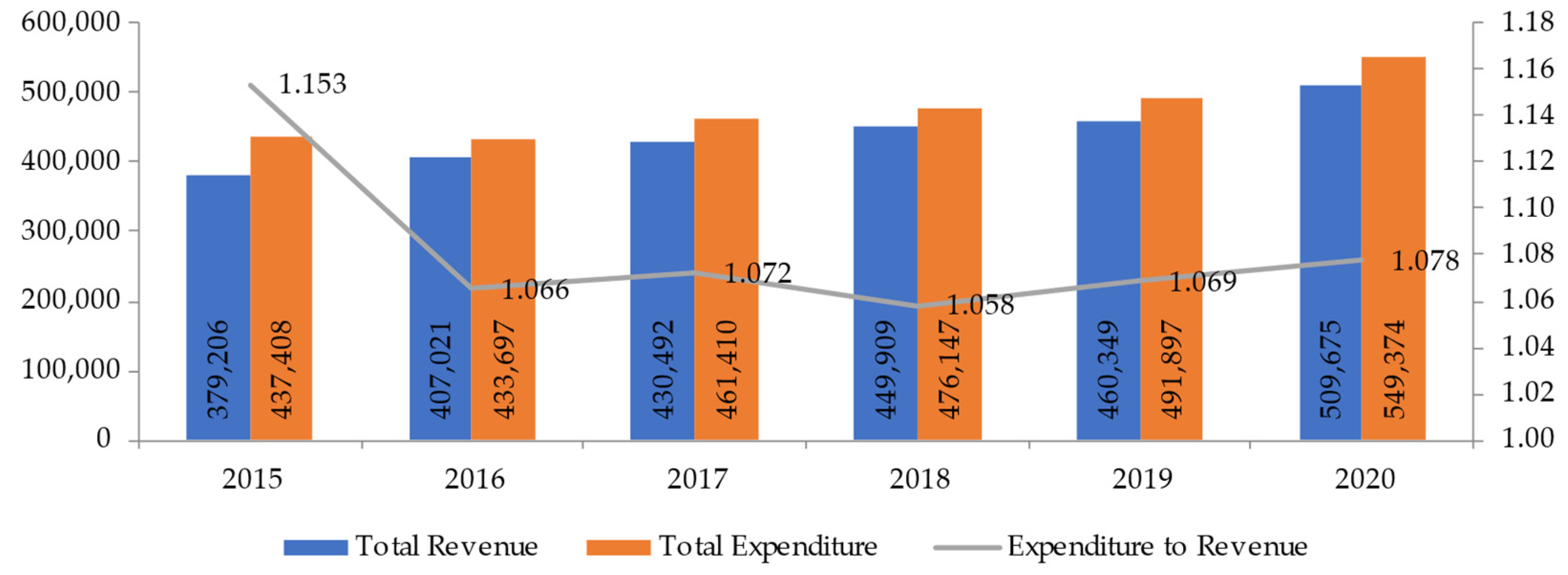

Assess the government's projected revenue streams, including taxes, fees, and external funding. This information can provide insights into the government's financial health and its ability to meet future obligations.

Tip 3: Consider Economic Assumptions

The budget is based on certain economic assumptions, such as GDP growth and inflation rates. Evaluate these assumptions to understand their potential impact on the budget and the broader economy.

Tip 4: Track Budget Execution

Monitor the government's progress in implementing the budget. This involves tracking actual expenditures and revenues against projections. Such monitoring allows for timely identification of any variance and enables adjustments if necessary.

Tip 5: Engage with Budgetary Stakeholders

Participate in public consultations and discussions related to the budget. By engaging with policymakers, businesses can voice their concerns, provide feedback, and influence the budget's formulation.

Summary

Effective navigation of the 2025 Greek Government Budget requires a thorough understanding of its key components and their implications for businesses and individuals. By following these tips, one can gain valuable insights into the nation's financial direction and make informed decisions accordingly.

2025 Greek Government Budget: A Comprehensive Guide

The Greek government budget for 2025 presents a roadmap for the country's financial trajectory. It is a crucial document that outlines the government's plans for revenue collection, expenditure allocation, and economic policies.

These key aspects of the 2025 Greek Government Budget are interconnected and have significant implications for the country's fiscal health and economic outlook. Understanding these aspects enables stakeholders to assess the government's financial plans, evaluate economic policies, and make informed decisions based on the budget's forecasts.

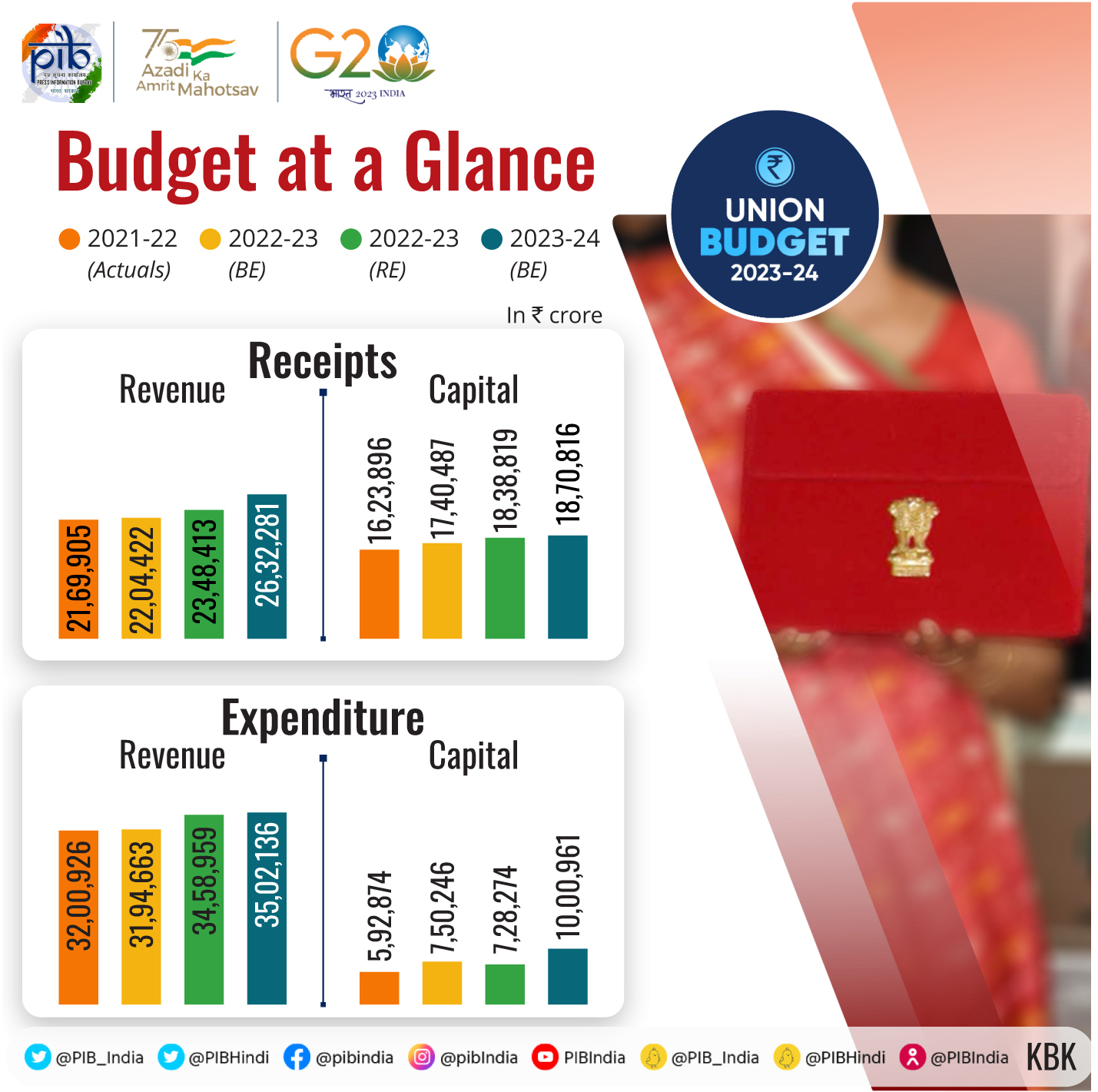

Union Budget 2023-24 Highlights & Complete Budget Analysis - Source currentaffairs.adda247.com

2025 Greek Government Budget: A Comprehensive Guide

The 2025 Greek Government Budget is a comprehensive financial plan outlining the government's projected revenues and expenditures for the year 2025. It is a crucial component of the government's overall economic and fiscal strategy, providing a roadmap for public spending priorities and revenue-generating measures. Understanding the contents of this budget is essential for assessing the government's fiscal health, economic policies, and their potential impact on businesses, citizens, and the economy as a whole.

Greek Draft Budget Sumbitted on Monday, Oct. 7 - Source www.tovima.com

The budget includes detailed information on government spending across various sectors, such as education, healthcare, infrastructure, and social welfare programs. It also outlines the government's revenue projections from sources like taxation, privatization, and EU funds. By analyzing this information, stakeholders can gain insights into the government's priorities and how it intends to allocate resources to meet the needs of the country.

Furthermore, the budget serves as a basis for evaluating the government's fiscal sustainability and its adherence to EU fiscal rules. It provides data on the government's debt levels, deficit targets, and economic growth projections, enabling analysts to assess the country's financial stability and its ability to meet its financial obligations. This information is crucial for investors, creditors, and international organizations when making decisions related to Greece's economy.

Overall, the 2025 Greek Government Budget is a valuable resource for understanding the government's fiscal plans and their implications for the economy and society. By delving into its contents, stakeholders can make informed decisions and contribute to informed public discourse on economic issues.