Indian Mutual Fund Investors Tread Cautiously Amidst Market Uncertainty

The Indian mutual fund industry has witnessed a surge in inflows in recent years, driven by factors such as rising financial awareness, increasing disposable income, and the search for better returns. However, the current market uncertainty, characterized by geopolitical tensions, inflation, and interest rate hikes, has led to a more cautious approach among Indian mutual fund investors.

Editor's Note: Indian Mutual Fund Investors Tread Cautiously Amidst Market Uncertainty published on July 19, 2023. This topic is important to read to get an insight Indian Mutual Fund Investors.

To help investors navigate this challenging landscape, we have analyzed the latest data and insights to provide a comprehensive guide to the current state of the Indian mutual fund industry. Our research has identified several key trends that are shaping investor behavior and the overall market outlook.

Key Differences or Key Takeaways

| Pre-Uncertainty | Amidst Uncertainty | |

|---|---|---|

| Investor Sentiment | Bullish, high risk appetite | Cautious, moderate risk appetite |

| Investment Focus | Growth-oriented, high-return schemes | Value-oriented, stable-return schemes |

| Market Volatility | Low | High |

Transition to main article topics

FAQ

Indian Mutual Fund Investors Tread Cautiously Amidst Market Uncertainty provides valuable insights and strategies for navigating the challenging market landscape. To further assist investors, this section addresses frequently asked questions (FAQs) that can help clarify uncertainties and empower informed decision-making.

MF Data Snapshot: Equity Flows Revive In December; SIPs At All-time - Source medium.com

Question 1: How can I mitigate risks in a volatile market?

Answer: Diversification, asset allocation, and regular rebalancing are crucial risk management strategies. Spreading investments across different asset classes and within asset classes helps reduce overall risk. Regular rebalancing ensures the portfolio remains aligned with risk tolerance and investment goals.

Question 2: What should I do if my portfolio is underperforming?

Answer: Assess the underlying reasons for underperformance. Conduct a thorough review of the fund's investment strategy, manager performance, and overall market conditions. Consider adjusting the portfolio based on risk tolerance and long-term goals. Staying invested during market fluctuations is generally recommended unless there is a fundamental change in investment objectives.

Question 3: When is it a good time to invest in mutual funds?

Answer: The best time to invest is when the long-term investment goals and risk tolerance align with the market conditions. Market timing is difficult, and it's important to focus on a long-term investment approach rather than trying to predict short-term market movements.

Question 4: Should I invest in actively managed or passively managed funds?

Answer: The choice between actively managed and passively managed funds depends on factors such as investment goals, risk tolerance, and the investor's understanding of the market. Actively managed funds offer the potential for higher returns, but they come with higher fees and may not always outperform the benchmark. Passively managed funds aim to match or track a specific index, offering lower fees but potentially lower returns.

Question 5: How often should I review my portfolio?

Answer: Regularly reviewing the portfolio ensures it remains aligned with investment goals and risk tolerance. The frequency of review can vary depending on market conditions and individual preferences. It's generally recommended to review the portfolio at least once a year or more frequently during periods of market volatility.

Question 6: Is it wise to invest in international mutual funds?

Answer: Diversifying into international mutual funds can provide exposure to different markets and currencies, potentially reducing overall portfolio risk. However, it's important to consider the currency exchange rate fluctuations, geopolitical risks, and the fund's management fees when investing in international funds.

By understanding the answers to these common questions, Indian mutual fund investors can navigate the market with greater confidence and make informed decisions that align with their financial objectives.

For further insights and guidance, explore the rest of the provided article.

Tips

Indian Mutual Fund Investors Tread Cautiously Amidst Market Uncertainty

Best Performing Mutual Funds 2024 India - Sissy Ealasaid - Source elviraqnadiya.pages.dev

In these uncertain times, it is crucial for mutual fund investors in India to proceed with caution and adopt a prudent approach. Here are a few guidelines to help navigate the current market volatility:

Tip 1: Reassess Risk Tolerance: Re-evaluate your risk appetite in light of the market's current volatility. Consider adjusting your portfolio's asset allocation to align with your revised risk profile.

Tip 2: Long-Term Perspective: Maintain a long-term investment horizon to minimize the impact of short-term market fluctuations. Historical data suggests that long-term investments in well-diversified portfolios can generally weather market downturns.

Tip 3: Diversify Investments: Spread your investments across various asset classes and investment styles to reduce overall portfolio risk. Consider a mix of equity, debt, and gold to mitigate potential losses in any one asset class.

Tip 4: Monitor Investments Regularly: Keep a watchful eye on your investments and review them periodically. Monitor the performance of your funds against benchmarks and peers to identify any underperformers.

Tip 5: Seek Professional Advice: If you feel overwhelmed or uncertain about your investment strategy, consult a financial advisor. A qualified professional can provide personalized guidance and help you make informed investment decisions.

Conclusion: Navigating market uncertainty requires a cautious and measured approach. By carefully considering these tips, mutual fund investors in India can position their portfolios to weather the storm and emerge stronger over the long term.

Indian Mutual Fund Investors Tread Cautiously Amidst Market Uncertainty

Indian mutual fund investors have adopted a cautious approach amidst persisting market uncertainty. Key aspects influencing this cautious stance include:

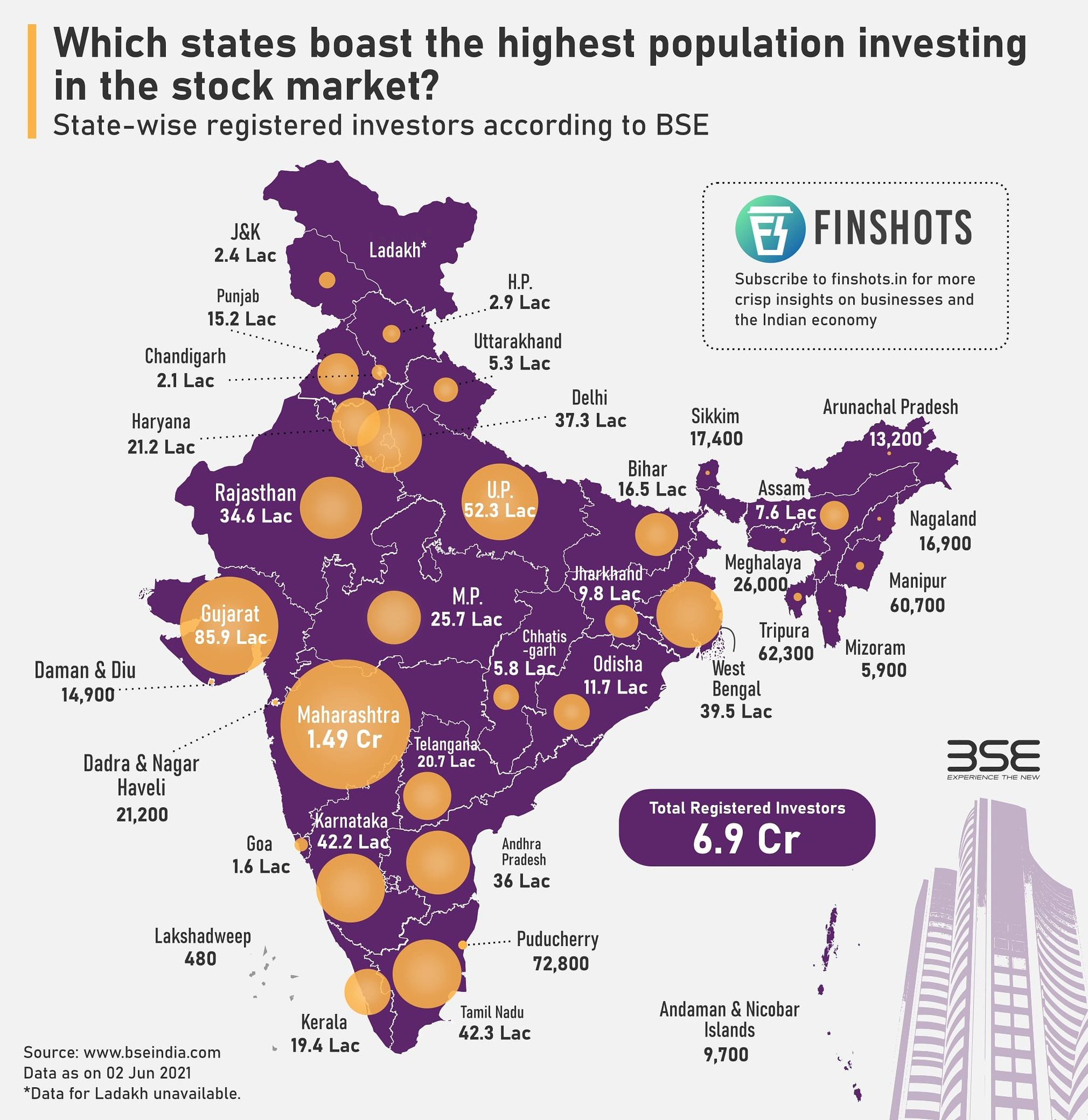

Finshots on Twitter: "Here's a look at the state-wise registered - Source twitter.com

These cautious measures reflect the prevailing market uncertainty and investors' desire for financial stability. While short-term market fluctuations may cause anxiety, staying invested and focusing on long-term goals remains crucial for wealth creation.

Detailed list of the types of mutual funds in India in 2021 | Samco - Source www.samco.in

Indian Mutual Fund Investors Tread Cautiously Amidst Market Uncertainty

Amidst the prevailing market uncertainty, Indian mutual fund investors are exhibiting a cautious approach. This prudence stems from the recent market volatility and global economic headwinds. The ongoing Russia-Ukraine conflict, rising inflation, and potential interest rate hikes by central banks have created a sense of unease among investors.

Basic Understanding of Mutual Fund! - Source 2640kf.imgcorp.com

This caution is reflected in the recent flow of investments into mutual funds. According to industry data, net inflows into equity-oriented mutual funds have declined in recent months. Investors are preferring to park their money in less risky options such as fixed income and liquid funds.

However, despite the current caution, the long-term growth potential of the Indian economy and the resilience of the mutual fund industry continue to attract investors. Mutual funds offer diversification, professional management, and the ability to participate in the growth of the stock market over the long term.

As the market environment evolves, mutual fund investors should stay informed, assess their risk tolerance, and make investment decisions in line with their financial goals.

| Investor Behavior | Reasons for Caution | Implications for Mutual Fund Industry |

|---|---|---|

| Increased Risk Aversion | Market Volatility, Global Economic Uncertainties | Reduced Equity Inflows, Shift Towards Safer Assets |

| Preference for Fixed Income and Liquid Funds | Seeking Stability Amidst Market Fluctuations | Growth in Fixed Income and Liquid Fund Categories |

| Long-Term Focus Remains | Recognition of India's Growth Potential, Resilience of Mutual Funds | Sustained Investor Interest in Mutual Funds Over Time |

Conclusion

In the face of market uncertainty, Indian mutual fund investors are navigating the landscape with caution. While short-term volatility may influence their investment decisions, the long-term growth prospects of the economy and the advantages of mutual funds continue to attract their interest. Investors should monitor market conditions, assess their risk appetite, and make informed decisions aligned with their financial objectives.

The resilience and adaptability of the mutual fund industry will be crucial in supporting investors during uncertain times. By providing a range of investment options, professional guidance, and long-term value creation, mutual funds can help investors navigate market fluctuations and achieve their financial goals.