Are you searching for detailed information about Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance? You are in the right place, we are providing in-depth knowledge related to Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance. This article is designed to provide you with a comprehensive understanding of Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance.

Editor's Notes: Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance has published on 26th May 2023. Microfinance is an essential tool in the fight against poverty. It can provide the financial means for people to start and grow businesses, which can lead to increased income and improved living standards.

Our analysis and information gathering on Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance focused on providing valuable content to our readers. We have made every effort to ensure accuracy and reliability in the article.

Key differences or Key takeways"

Here are some key differences or key takeaways from Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance:

| Muhammad Yunus | Nobel Laureate | Pioneer of Microfinance |

|---|---|---|

| Muhammad Yunus is a Bangladeshi social entrepreneur, banker, economist, and civil society leader who was awarded the Nobel Peace Prize for founding the Grameen Bank. | He is a pioneer of microfinance, which is a type of banking that provides financial services to poor and low-income people who do not have access to traditional banking services. | Yunus has been a vocal advocate for microfinance and has helped to spread the concept around the world. |

Transition to main article topics"

Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance is a complex topic with many different aspects. In this article, we will discuss the following:

- Muhammad Yunus's early life and education

- The founding of the Grameen Bank

- The principles of microfinance

- The impact of microfinance on poverty reduction

- The challenges facing microfinance

- The future of microfinance

We hope that this article will provide you with a better understanding of the importance of Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance. If you have any questions, please feel free to contact us.

FAQ

This FAQ section addresses common questions and misconceptions surrounding microfinance pioneer and Nobel Laureate, Muhammad Yunus.

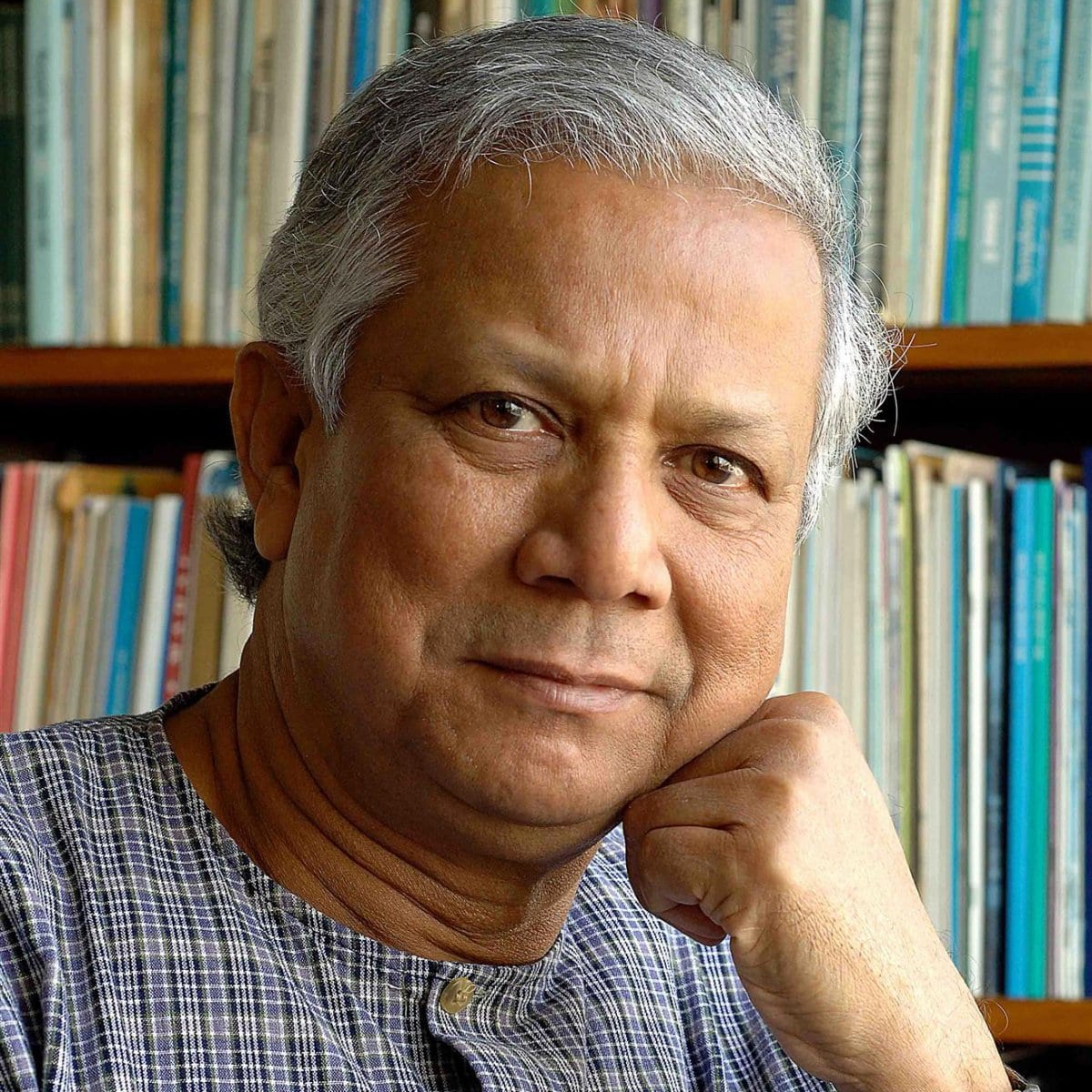

Question 1: Who is Muhammad Yunus?

Muhammad Yunus is a Bangladeshi economist and Nobel Peace Prize laureate. He is best known for pioneering the concept of microfinance, providing small loans to the poor to help them start businesses.

Goal of the Month | Exclusive Interview Professor Muhammad Yunus - Source www.un.org

Question 2: What is microfinance?

Microfinance is the provision of financial services to low-income individuals or groups who are not served by traditional banks. These services can include loans, savings, and insurance.

Question 3: Why is microfinance important?

Microfinance empowers the poor by providing them with the resources they need to start businesses, increase their income, and improve their lives.

Question 4: What is the Grameen Bank?

The Grameen Bank is a microfinance institution founded by Muhammad Yunus in 1983. It is one of the most successful microfinance programs in the world, and has provided loans to over 9 million people.

Question 5: What are the criticisms of microfinance?

Some critics argue that microfinance can lead to over-indebtedness, and that it does not always benefit the poor as intended. However, research has shown that microfinance can be an effective tool for poverty reduction.

Question 6: What is the future of microfinance?

Microfinance is a rapidly growing industry, and there is a growing demand for financial services for the poor. The future of microfinance looks bright, as it continues to empower the poor and help them to improve their lives.

Overall, Muhammad Yunus and the concept of microfinance have been instrumental in providing financial services to the poor and fostering economic growth worldwide.

Read more about Muhammad Yunus and his work in the 'About' section.

Tips by Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance

Muhammad Yunus, the Nobel Peace Prize laureate and pioneer of microfinance, has dedicated his life to empowering the poor through access to financial services. His insights on poverty alleviation and social entrepreneurship have transformed the way we approach development. Here are some key tips from his extensive experience:

Tip 1: Empower Individuals, Not Institutions

Yunus emphasized the importance of empowering individuals rather than institutions. By providing microloans directly to the poor, microfinance helps them break free from the cycle of poverty and build self-sufficiency.

Tip 2: Credit Is a Human Right

Yunus believed that access to credit is a fundamental human right. By challenging traditional banking practices, microfinance institutions provide financial services to those who have been historically excluded.

Tip 3: Poverty Is Not a Lack of Money

Yunus argued that poverty is not simply a lack of money, but a lack of opportunity. Microfinance empowers individuals to invest in businesses, education, and healthcare, creating opportunities for them to improve their lives.

Tip 4: Focus on Social Impact

Yunus emphasized the importance of measuring the social impact of microfinance. By tracking indicators such as poverty reduction and women's empowerment, institutions can ensure that their efforts are making a tangible difference.

Tip 5: Collaboration is Key

Yunus stressed the power of collaboration between governments, NGOs, and the private sector. By working together, these stakeholders can create a more inclusive financial system that reaches the most vulnerable.

These tips provide a valuable framework for those working to eradicate poverty and promote social justice. Muhammad Yunus's legacy as a pioneer of microfinance continues to inspire generations to create a more equitable and sustainable world.

Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance

Muhammad Yunus, a renowned economist from Bangladesh, has revolutionized the financial landscape by introducing the concept of microfinance. His pioneering efforts in providing small loans to the impoverished have earned him the Nobel Peace Prize in 2006. This content delves into six key aspects that encapsulate his contributions to microfinance and his role as a visionary leader.

- Microcredit Pioneer: Yunus established the Grameen Bank, which pioneered the concept of lending small amounts of money to the poor, particularly women.

- Social Entrepreneur: Yunus's work extended beyond microcredit, as he founded the Grameen family of companies to address various social issues through entrepreneurial solutions.

- Advocate for Women's Empowerment: He recognized the transformative power of microfinance for women, providing them access to financial resources and fostering their independence.

- Nobel Laureate: In 2006, Yunus and Grameen Bank were jointly awarded the Nobel Peace Prize for their contributions to poverty alleviation and social development.

- Global Microfinance Movement: Yunus's ideas inspired a global microfinance movement, with similar institutions being established in over 100 countries.

- Sustainable Development Champion: Yunus emphasized the importance of microfinance as a tool for sustainable development, promoting financial inclusion and reducing poverty.

Congratulations Bangladesh Nobel laureate Muhammad Yunus to get Olympic - Source yogagivesback.org

Muhammad Yunus's transformative microfinance model has provided financial empowerment to millions of impoverished individuals worldwide. By recognizing the potential of the poor and the power of small loans, he has ignited a global movement that continues to empower communities and promote sustainable development. His legacy as a Nobel laureate and pioneering microfinance advocate will continue to inspire future generations to address poverty and strive for a more equitable society.

ways to achieve world peace: Nobel Peace Prize-winner Muhammad Yunus - Source peacebyone.blogspot.com

Muhammad Yunus: Nobel Laureate And Pioneer Of Microfinance

Muhammad Yunus is a Bangladeshi social entrepreneur, banker, economist, and civil society leader who is widely recognised for his pioneering work in the field of microfinance. He is the founder of Grameen Bank, a microfinance organisation and community development bank that has provided millions of poor people in Bangladesh with access to credit and other financial services. Yunus was awarded the Nobel Peace Prize in 2006 for his efforts to promote economic and social development through microfinance.

Approaches to Development Part II: Microfinance – NAOC - Source natoassociation.ca

Microfinance is the provision of financial services to low-income individuals or groups who are not served by traditional banks or other financial institutions. These services can include small loans, savings accounts, and insurance. Microfinance has been shown to be an effective way to reduce poverty and inequality, and to promote economic development.

Yunus's work in microfinance has had a profound impact on the lives of millions of people around the world. Grameen Bank has helped to create a more just and equitable society in Bangladesh, and has inspired the creation of similar microfinance organisations in other countries.

| Year | Event | Impact |

|---|---|---|

| 1976 | Yunus founds Grameen Bank | Thousands of poor women receive microloans, sparking economic development |

| 2006 | Yunus wins Nobel Peace Prize | Microfinance gains international recognition as a tool for poverty reduction |

| 2011 | Yunus leaves Grameen Bank | Bank faces criticism for high interest rates and questionable practices |

| Present | Yunus continues to advocate for microfinance | He advises governments and organizations on how to use microfinance effectively |

Conclusion

Muhammad Yunus's work in microfinance has shown that it is possible to make a real difference in the lives of the poor. Microfinance has the potential to help people lift themselves out of poverty, and to create a more just and equitable society.

Yunus's work is an inspiration to us all. It shows us that even the smallest of actions can make a big difference in the world.