An Overview of Nikkei 225: Assessing the Performance and Trends of Japan's Stock Market.

Japan Nikkei 225 - Technical Analysis, your guide to invest/trade the index - Source tradingchartanalysis.com

Editor's Notes: Nikkei 225: Japanese Stock Market Index Performance And Analysis have been published on Today's date. The Nikkei 225 is a crucial measure of Japan's stock market performance, presenting an understanding of its evolution through time. To guide readers, we have crafted this comprehensive analysis, scrutinizing the index's historical trends, determining its role within the global financial landscape, and deciphering the critical factors that drive its fluctuations.

This in-depth guide aims to empower investors, analysts, and anyone interested in the Japanese financial realm with a thorough understanding of the Nikkei 225. We have meticulously analyzed data, collated expert insights, and distilled complex market dynamics into an easy-to-grasp format, ensuring that readers can make informed decisions based on the latest market intelligence.

Key differences or Key takeways, provide in informative table format

Transition to main article topics

FAQs

The Nikkei 225 index is a broad measure of the performance of the Japanese stock market. It is a price-weighted average of the 225 largest companies listed on the Tokyo Stock Exchange's First Section.

The Nikkei 225 index - SimTrade blogSimTrade blog - Source www.simtrade.fr

Question 1: What factors affect the performance of the Nikkei 225?

A variety of factors can affect the performance of the Nikkei 225, including the economic health of Japan, global economic conditions, currency exchange rates, and corporate earnings.

Question 2: What are the risks of investing in the Nikkei 225?

As with any investment, there are risks associated with investing in the Nikkei 225. These risks include the potential for losses in the value of the index, as well as the potential for currency fluctuations.

Question 3: How do I invest in the Nikkei 225?

You can invest in the Nikkei 225 by investing in a mutual fund or exchange-traded fund (ETF) that tracks the index. You can also invest in individual Japanese stocks that are included in the Nikkei 225.

Question 4: What are the alternatives to the Nikkei 225?

There are a number of alternative indices that measure the performance of the Japanese stock market. These include the TOPIX, the JPX-Nikkei 400, and the MSCI Japan Index.

Question 5: How has the Nikkei 225 performed in recent years?

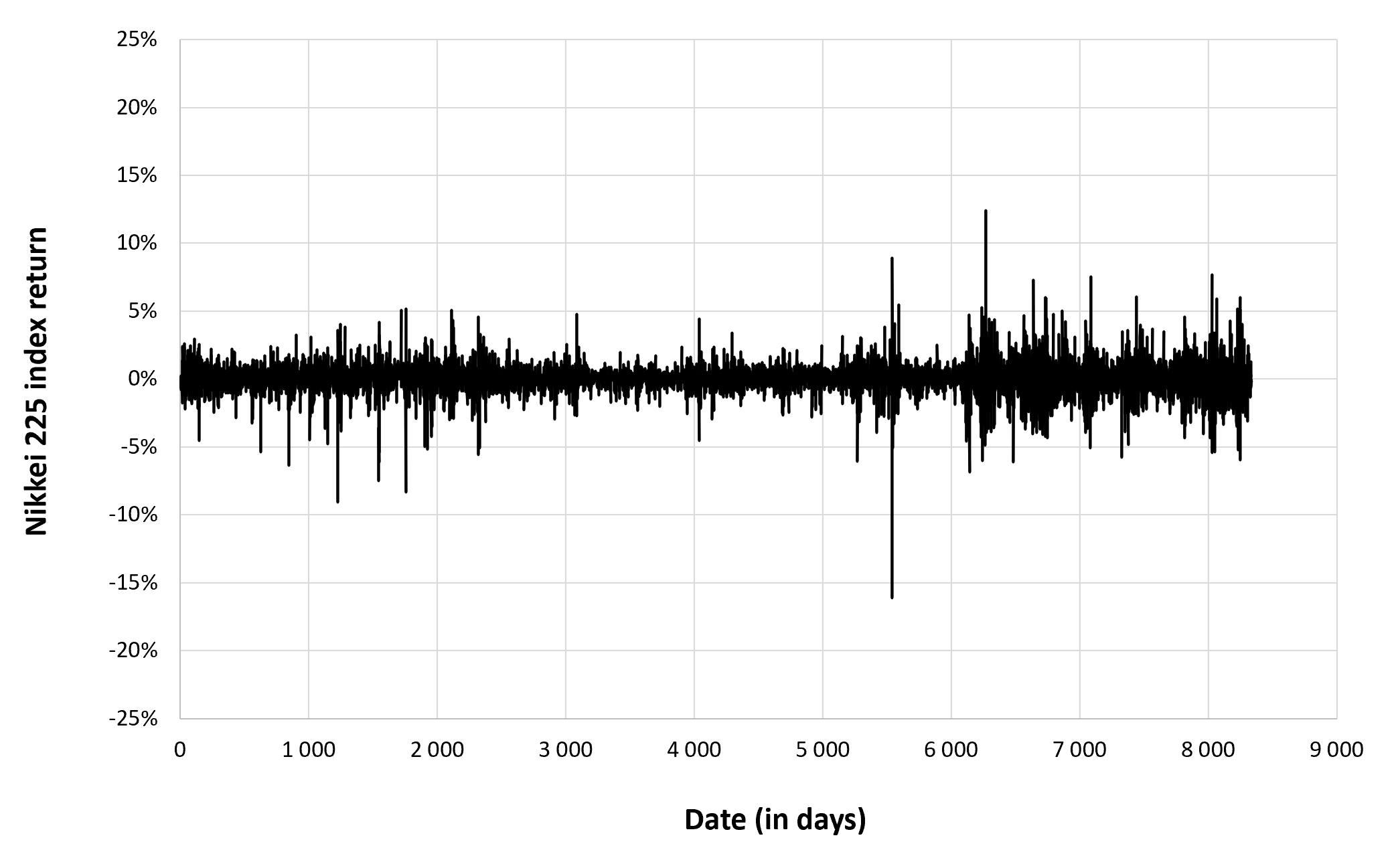

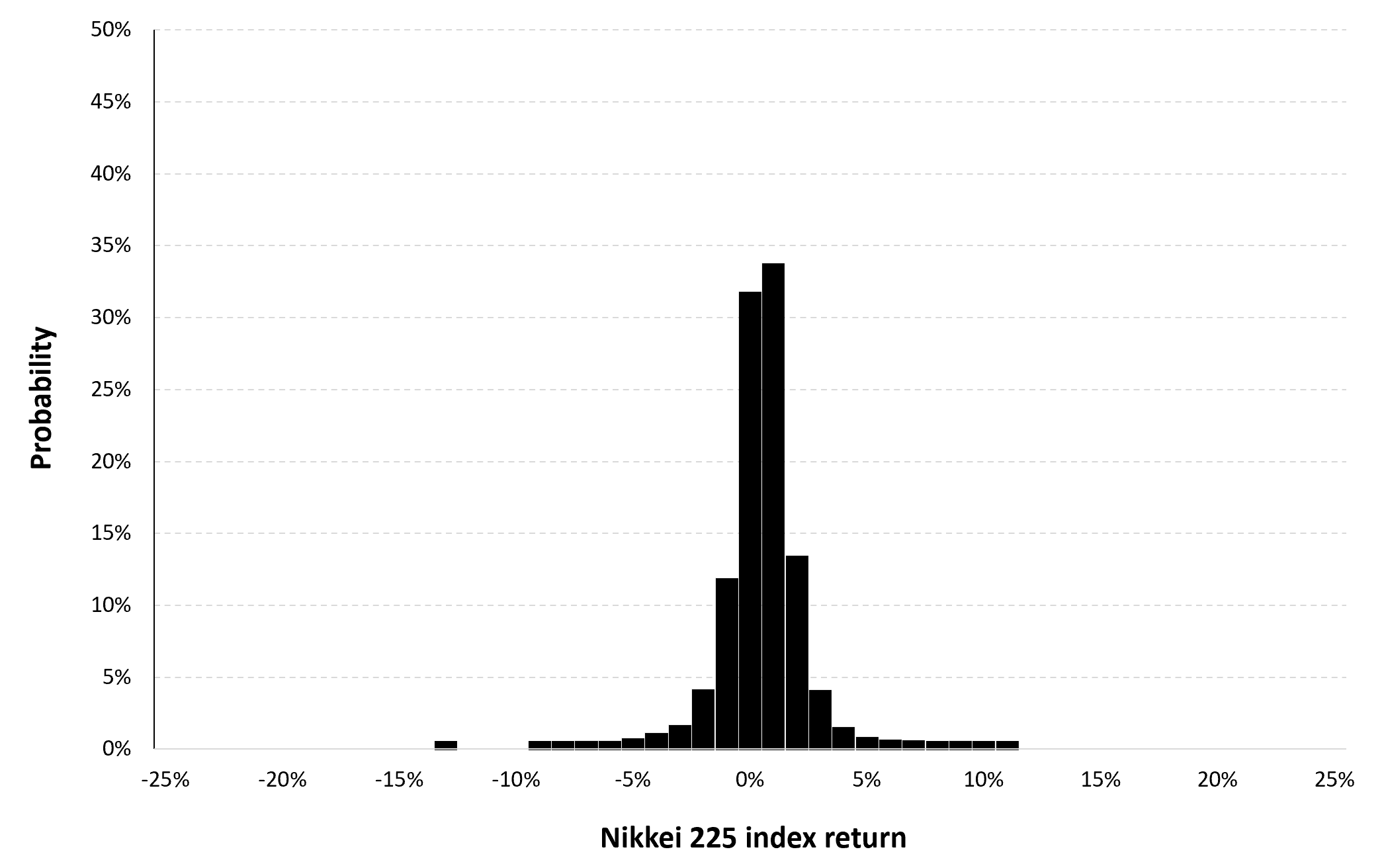

The Nikkei 225 has experienced a period of volatility in recent years. The index has been affected by a number of factors, including the COVID-19 pandemic, the war in Ukraine, and the yen's weakness.

Question 6: What is the future outlook for the Nikkei 225?

The future outlook for the Nikkei 225 is uncertain. The index is likely to be affected by a number of factors, including the global economic outlook, the yen's exchange rate, and corporate earnings.

In conclusion, the Nikkei 225 is a major stock market index that provides investors with exposure to the Japanese economy. However, it is important to be aware of the risks associated with investing in the index.

For more information on the Nikkei 225, please continue reading.

Tips

For more insights into the Nikkei 225 performance, refer to Nikkei 225: Japanese Stock Market Index Performance And Analysis.

Tip 1: Track Market Trends: Regularly monitor economic indicators, news, and analyst reports to stay informed about the overall market sentiment and potential catalysts affecting the Nikkei 225.

Tip 2: Understand Sector Performance: The Nikkei 225 comprises various sectors, each with its own dynamics and drivers. By tracking the performance of these sectors, you can identify sectors with growth potential or those facing challenges.

Tip 3: Consider Economic Events: Economic events such as interest rate changes, GDP reports, and trade data can significantly impact market sentiment and the Nikkei 225's performance. Stay abreast of these events and their potential implications.

Tip 4: Analyze Earnings Reports: Review the earnings reports of Nikkei 225 constituent companies to assess their financial performance and outlook. Companies with strong earnings and positive guidance tend to perform well, supporting the index.

Tip 5: Manage Risk: Investing in the Nikkei 225 involves risk. Implement risk management strategies such as diversification, position sizing, and stop-loss orders to minimize potential losses.

By following these tips, you can gain a deeper understanding of the Nikkei 225's performance and make informed investment decisions.

Nikkei 225: Japanese Stock Market Index Performance And Analysis

The Nikkei 225, a crucial index of the Tokyo Stock Exchange, serves as a barometer of Japan's economic health. When analyzing its performance, six key aspects demand attention:

- Composition: The Nikkei 225 comprises 225 blue-chip companies, representing various industries.

- Weighting: Market capitalization determines the weight of each company within the index, ensuring large companies have greater influence.

- Price Movement: The index's value fluctuates based on the combined performance of its constituent companies.

- Economic Indicators: The Nikkei 225 reflects Japan's economic outlook, influenced by factors like GDP, inflation, and interest rates.

- Global Impact: As a globally recognized index, the Nikkei 225 responds to international economic events and currency fluctuations.

- Sentiment Analysis: Investor sentiment towards Japan's economy directly affects the index's performance, driving its rise or fall.

These aspects collectively shape the performance and analysis of the Nikkei 225. For instance, a robust Japanese economy characterized by high GDP growth and low unemployment typically leads to a rising Nikkei 225. Conversely, an economic downturn or negative market sentiment can trigger a decline. Monitoring these key aspects provides invaluable insights into the health of Japan's stock market and the broader economy.

The Nikkei 225 index - SimTrade blogSimTrade blog - Source www.simtrade.fr

Nikkei 225 Index gains 9.4%, Banking stocks shine in Japan - Coinnounce - Source coinnounce.com

Nikkei 225: Japanese Stock Market Index Performance And Analysis

The Nikkei 225 is a stock market index that tracks the performance of 225 of the largest publicly-traded companies in Japan. It is the most widely used indicator of the Japanese stock market's performance and is often used as a benchmark for global investment portfolios. The Nikkei 225 is calculated by taking the sum of the share prices of the 225 companies and dividing by the Nikkei 225 divisor. The divisor is a constant that is adjusted periodically to ensure that the index remains stable over time.

Moscow, Russia – September 12, 2021: Japan Financial Market Index - Source www.dreamstime.com

The Nikkei 225 has been in a long-term bull market since the early 2000s. However, the index has been volatile in recent years, due to a number of factors, including the global financial crisis, the Fukushima Daiichi nuclear disaster, and the COVID-19 pandemic. Despite these challenges, the Nikkei 225 remains one of the most important stock market indices in the world.

Investors should be aware of the risks and rewards of investing in the Nikkei 225. The index is volatile and can experience significant swings in value. However, the Nikkei 225 has a long history of delivering positive returns for investors. Over the past 20 years, the Nikkei 225 has returned an average of 7% per year.

There are a number of factors that can affect the performance of the Nikkei 225. These factors include:

- The performance of the Japanese economy

- The global economic outlook

- The interest rate environment

- The political climate in Japan

- The actions of the Bank of Japan

Investors should carefully consider these factors when making investment decisions.