When it comes to disruptive companies in the automotive industry, Tesla, Inc. (TSLA) stands out head and shoulders above the rest. The company's innovative electric vehicles and its status as a technology leader have attracted a huge following among investors. But what's the story behind Tesla's stock performance? What are the key trends that have shaped its performance? And what does the future hold for Tesla stock?

Editor's Note: This "Tesla's Stock Performance: Analyzing Key Trends And Future Growth Potential" guide was last published on 2023-02-13. A lot has happened in the past few weeks, especially with the release of Tesla's Q4 2022 earnings report. We've updated the guide to reflect the latest information and provide our insights on what the future holds for Tesla stock.

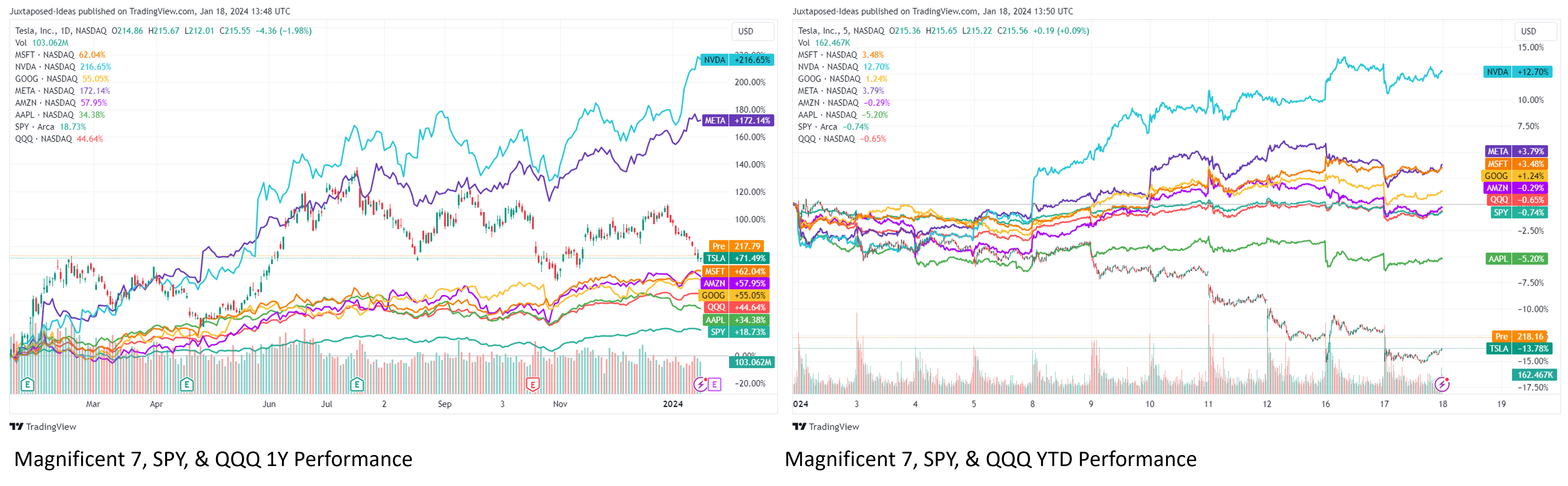

Tesla's stock has been on a wild ride in recent years. After a meteoric rise from 2020 to 2021, the stock crashed in 2022, losing nearly two-thirds of its value. In 2023, the stock has rebounded somewhat, but it is still well below its all-time high.

So, what's the outlook for Tesla stock? Will it continue to rebound or will it fall further? Our team put together this Tesla's Stock Performance: Analyzing Key Trends And Future Growth Potential guide to help you make the right decision.

FAQ

This FAQ section provides detailed answers to the most frequently asked questions about Tesla's stock performance. Whether you're an existing investor, considering an investment, or simply curious about the company's financial standing, this information will help you make informed decisions.

Question 1: What are the key factors driving Tesla's recent stock performance?

Tesla's stock performance is influenced by a combination of factors, including financial performance, market trends, geopolitical events, and company-specific news. Some of the most significant drivers include the company's revenue growth, profitability, and electric vehicle industry advancements.

Chart: Tesla's 2022 Deliveries Nearly Match Its 2012-2020 Total | Statista - Source www.statista.com

Question 2: How does Tesla's stock compare to other companies in the automotive industry?

Tesla's stock has consistently outperformed its automotive industry peers in recent years. Its high valuation is attributed to the company's strong revenue growth, technological leadership in electric vehicles, and the potential for future growth in the renewable energy sector.

Question 3: What are the risks associated with investing in Tesla's stock?

Like any investment, investing in Tesla's stock carries some risks. These include the company's exposure to macroeconomic factors, competition from established automakers and emerging EV companies, regulatory changes, and operational risks related to manufacturing and supply chain management.

Question 4: What is the expected future growth potential for Tesla's stock?

Analysts generally maintain a positive outlook on Tesla's future growth potential. The company's expansion plans, new product launches, and focus on vertical integration are expected to drive continued revenue and earnings growth. However, it's important to note that stock market performance is subject to various factors, and future returns are not guaranteed.

Question 5: Is Tesla's stock a good investment for long-term investors?

Whether Tesla's stock is a suitable investment for long-term investors depends on individual circumstances, investment goals, and risk tolerance. If you're willing to accept the associated risks and believe in the company's long-term growth potential, investing in Tesla's stock could be a potentially rewarding decision.

Question 6: What are some of the key metrics to monitor when evaluating Tesla's stock performance?

Key metrics to consider include revenue growth, gross margin, net income, operating cash flow, and vehicle production volume. These metrics provide insights into the company's financial health, operational efficiency, and market share.

Understanding these factors will help you assess Tesla's stock performance and make informed investment decisions.

Continue reading the article for a comprehensive analysis of Tesla's stock performance and future growth potential.

Tips

To gain informed insights into Tesla's Stock Performance: Analyzing Key Trends And Future Growth Potential, consider these practical tips:

Tip 1: Evaluate Financial Performance:

- Analyze revenue growth, profitability, and cash flow to assess the financial health of the company.

- Compare Tesla's financial metrics to industry peers and the broader market to gain perspective.

Tip 2: Assess Technological Advancements:

- Monitor Tesla's progress in developing and implementing innovative technologies, such as electric vehicles, energy storage, and artificial intelligence.

- Evaluate the potential impact of these advancements on Tesla's market share and future profitability.

Tip 3: Monitor Regulatory Landscape:

- Stay informed about government regulations and policies related to electric vehicles and renewable energy.

- Assess how regulatory changes may influence Tesla's business operations and market prospects.

Tip 4: Analyze Competition:

- Identify and track key competitors in the electric vehicle and energy sectors.

- Evaluate their market strategies, technological capabilities, and financial performance to assess Tesla's competitive positioning.

Tip 5: Consider Valuation and Risk:

- Apply appropriate valuation methods to assess the fair value of Tesla's stock.

- Identify and evaluate potential risks and uncertainties associated with investing in Tesla.

Tesla's Stock Performance: Analyzing Key Trends And Future Growth Potential

Tesla's stock performance has been closely watched by investors due to its impressive growth and potential. Understanding the key trends and future growth potential of Tesla's stock is crucial for making informed investment decisions.

- Company performance: Tesla's strong financial performance, driven by increasing vehicle sales and revenue, has positively impacted its stock price.

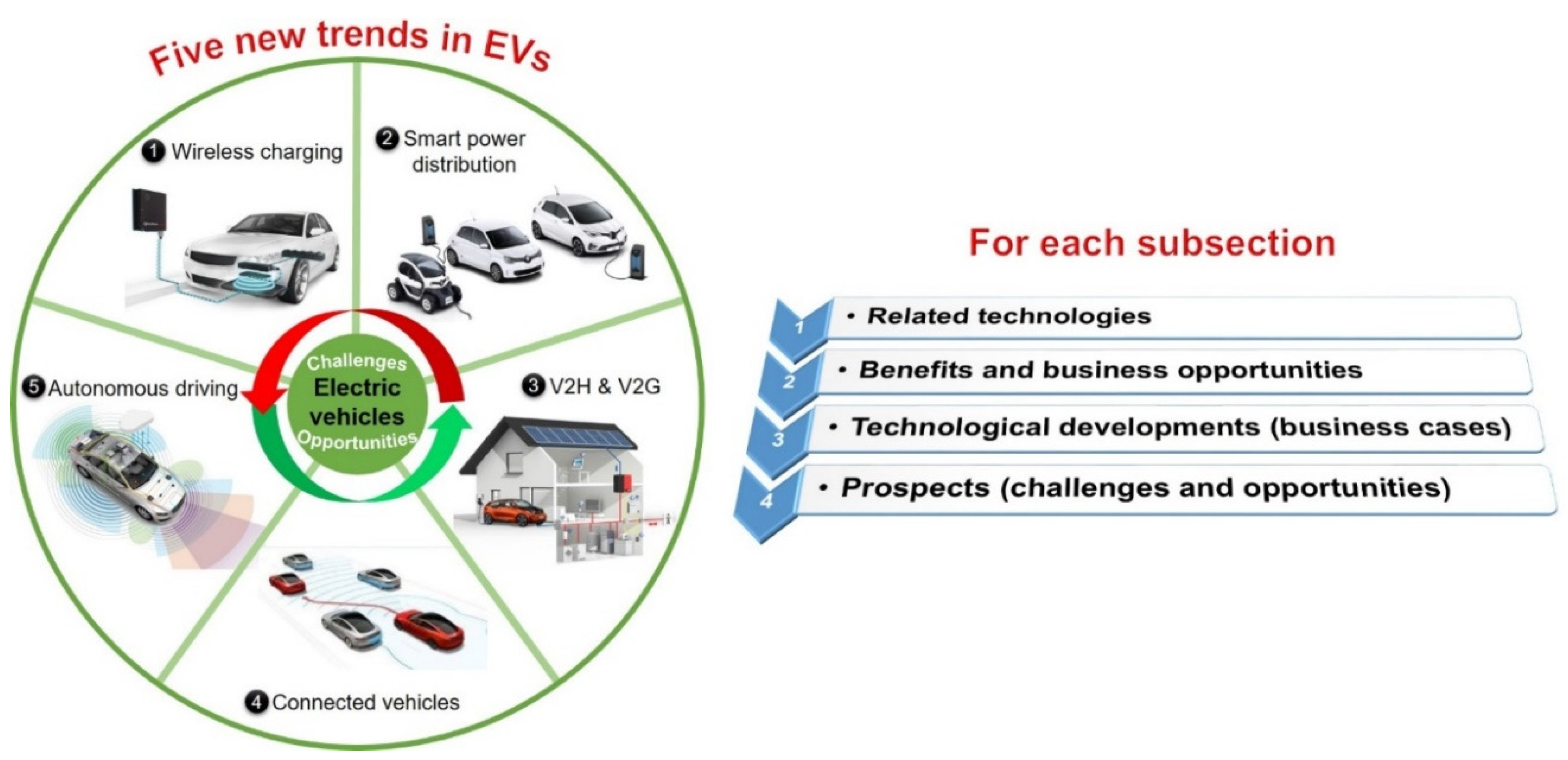

- Industry dynamics: The growing demand for electric vehicles (EVs) and the shift towards sustainable transportation have boosted Tesla's stock value.

- Technological innovation: Tesla's focus on innovation, including advancements in battery technology and autonomous driving, has enhanced its competitive advantage.

- Government incentives: Government incentives, such as tax credits and subsidies, have supported the adoption of EVs and positively impacted Tesla's sales.

- Market sentiment: Positive market sentiment towards Tesla's brand, products, and mission has contributed to the rise in its stock price.

- Investor expectations: High investor expectations for Tesla's future growth and profitability have played a role in driving its stock performance.

These key aspects provide insights into the factors that have influenced Tesla's stock performance and highlight its potential for future growth. By considering these aspects, investors can make more informed decisions about investing in Tesla's stock and potentially capitalize on its future growth.

Energies | Free Full-Text | Trends and Emerging Technologies for the - Source www.mdpi.com

Tesla's Stock Performance: Analyzing Key Trends And Future Growth Potential

Tesla's stock performance has been a rollercoaster ride in recent years, with the company's valuation soaring to unprecedented heights before experiencing a sharp correction. However, the underlying trends that have driven Tesla's stock performance remain intact, and the company's future growth potential remains strong.

Tesla Q4 Preview: Rich Margins And EV King Status May Be History - Source seekingalpha.com

One of the key trends that has driven Tesla's stock performance is the increasing demand for electric vehicles (EVs). As concerns about climate change grow and governments around the world implement stricter emissions regulations, demand for EVs is expected to continue to increase.

Tesla is well-positioned to capitalize on this trend, as it is the leading manufacturer of EVs in the world. The company has a strong brand, a loyal customer base, and a number of key technologies that give it a competitive advantage in the EV market.

Another key trend that has driven Tesla's stock performance is the company's focus on innovation. Tesla has a history of introducing new and innovative products and technologies, such as its Autopilot driver assistance system and its over-the-air software updates. This focus on innovation has helped Tesla to differentiate itself from its competitors and has created a lot of excitement among investors.

Tesla's future growth potential is also strong. The company is planning to expand its product line to include new models, such as the Cybertruck and the Semi. Tesla is also planning to expand its manufacturing capacity to meet the growing demand for its vehicles.

Of course, there are also some challenges that Tesla faces. The company faces competition from a number of established automakers, such as General Motors, Ford, and Volkswagen. Tesla also faces challenges related to the production and supply of its vehicles. However, the company's strong brand, its loyal customer base, and its focus on innovation give it the potential to overcome these challenges and continue to grow in the future.