Tata Motors Stock Split: Boosting Shareholder Value And Liquidity

Tata Motors Stock Split: Boosting Shareholder Value And Liquidity

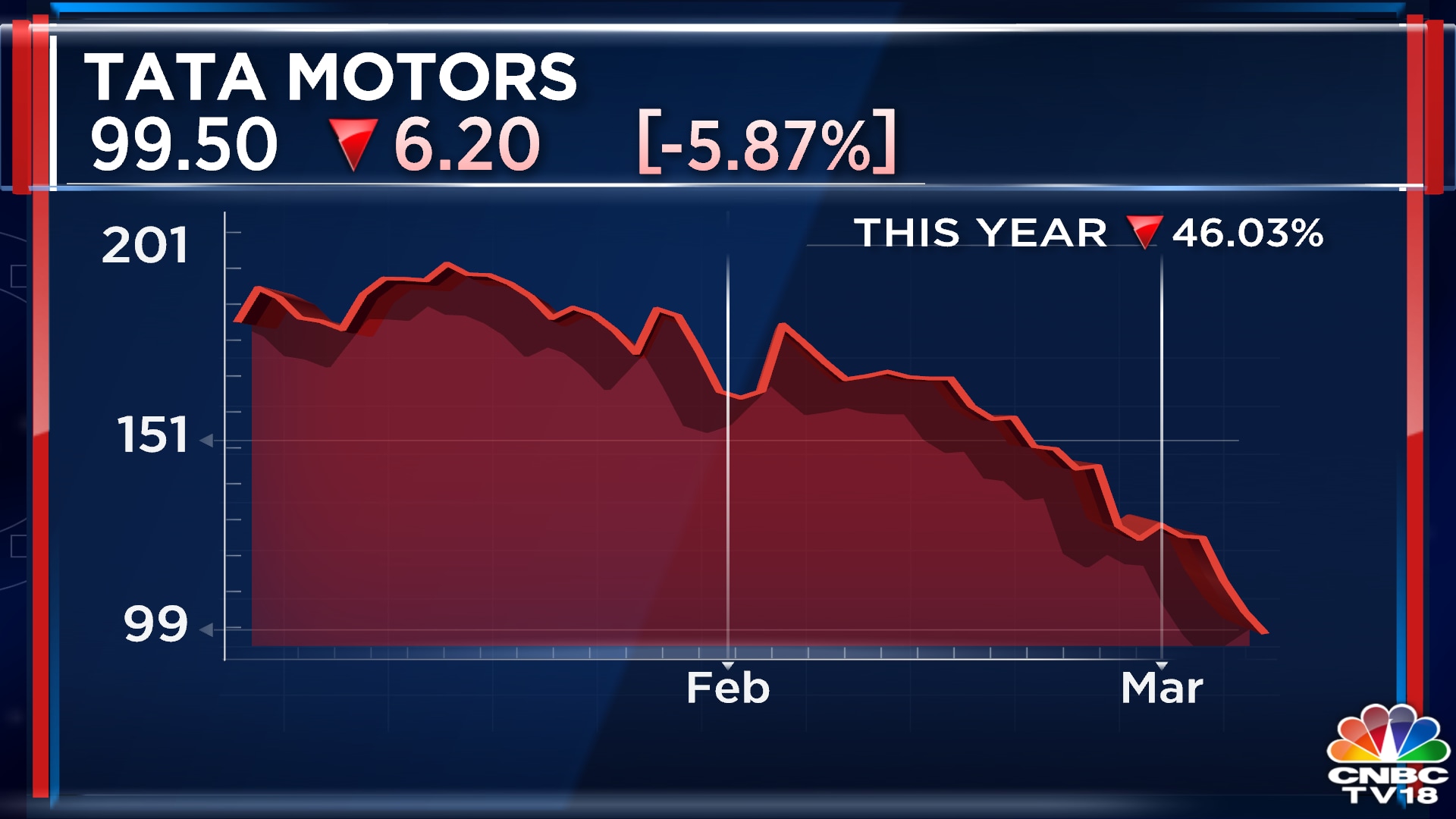

Tata Motors share price ends below Rs 100 for first time since 2009 - Source www.cnbctv18.com

Editor's Notes: "Tata Motors Stock Split: Boosting Shareholder Value And Liquidity" have published today date". Give a reason why this topic important to read.

Our team of experts has analyzed the latest trends and developments in the stock market to bring you this comprehensive guide on Tata Motors Stock Split: Boosting Shareholder Value And Liquidity. We hope this guide will help you make informed decisions about your investments.

Key Differences or Key Takeaways

| Feature | Tata Motors Stock Split |

|---|---|

| Ratio | 1:10 |

| Ex-date | February 15, 2023 |

| Record date | February 16, 2023 |

Transition to main article topics

FAQ

This section provides answers to frequently asked questions (FAQs) regarding Tata Motors' stock split, offering insightful details to enhance understanding and address any queries.

Tata Motors Stock Study - Strengths, SWOT & Fundamental Analysis! - Source tradebrains.in

Question 1: What is a stock split?

A stock split involves dividing each existing share of a company into multiple shares, effectively increasing the total number of shares while maintaining the market capitalization. For instance, in a 2:1 split, each shareholder with one share receives two shares, doubling their holdings but retaining the same overall value.

Question 2: What are the benefits of a stock split?

Stock splits can offer several advantages. Firstly, they improve affordability, making the stock more accessible to small investors with limited capital. Secondly, they can increase trading liquidity, attracting a wider range of investors and potentially enhancing market activity. Thirdly, stock splits often signal corporate confidence in future growth prospects, conveying a positive message to the market.

Question 3: What is the rationale behind Tata Motors' stock split?

Tata Motors' decision to implement a stock split is driven by the desire to enhance shareholder value and liquidity. The split aims to make the stock more affordable, particularly for retail investors, and to create a broader ownership base. By increasing the number of shares, Tata Motors seeks to attract new investors and improve the stock's trading volume.

Question 4: Will the stock split affect the share price?

Post-split, the market capitalization of the company remains unchanged, meaning the total value of all outstanding shares remains the same. While the number of shares increases, the value of each individual share decreases proportionally, maintaining an equivalent overall value for shareholders.

Question 5: What are the tax implications of a stock split?

Stock splits are generally not taxable events as they do not alter the shareholder's proportionate ownership in the company. The cost basis for each share is adjusted accordingly, reflecting the increased number of shares. Investors should consult with a tax professional for specific guidance regarding their individual circumstances.

Question 6: When will the stock split become effective?

The effective date of the stock split is typically announced by the company. Shareholders should monitor company announcements and refer to official sources for the most up-to-date information.

In conclusion, Tata Motors' stock split is a strategic move to enhance shareholder value and liquidity by making the stock more accessible to a broader range of investors. While the total market capitalization remains unaffected, the split aims to increase trading volume and convey positive market sentiment. Shareholders should stay informed about the effective date and consult with a tax professional for any specific tax-related questions.

Stay tuned for the next section, where we delve into the potential impact of the stock split on Tata Motors' share price and explore market analysts' perspectives.

Tips for Enhanced Shareholder Value and Liquidity

How Tata Motors plans to take on Maruti | Mint - Source www.livemint.com

Tata Motors' strategic decision to split its stock offers numerous advantages to its shareholders:Tata Motors Stock Split: Boosting Shareholder Value And Liquidity

Tip 1: Increased Accessibility and Liquidity:

A stock split reduces the price per share, making it more affordable for smaller investors. This increased liquidity allows for easier trading and potentially attracts new investors.

Tip 2: Enhanced Portfolio Diversification:

Stock splits enable investors to diversify their portfolios by purchasing a larger number of shares at a lower price. This diversification helps mitigate overall investment risk.

Tip 3: Improved Shareholder Sentiment:

Stock splits often boost shareholder morale as they indicate a belief in the company's future growth potential. This positive sentiment can drive demand and support higher share prices.

Tip 4: Potential for Future Growth:

Companies that split their stock generally have strong fundamentals and positive growth prospects. Stock splits can serve as an indicator of a company's confidence in its future performance.

Tip 5: Enhanced Corporate Image:

Stock splits convey a positive image of the company as it demonstrates a commitment to shareholder value creation and transparency.

In conclusion, Tata Motors' stock split presents a valuable opportunity for shareholders to benefit from increased liquidity, enhanced portfolio diversification, improved shareholder sentiment, and the potential for future growth.

Tata Motors Stock Split: Boosting Shareholder Value And Liquidity

Tata Motors' recent stock split has generated significant interest among investors, as it is expected to enhance shareholder value and liquidity. This article explores six key aspects of the stock split that are essential for investors to consider.

- Increased Shareholder Accessibility: The stock split makes shares more affordable and accessible to a wider range of investors.

- Enhanced Liquidity: A larger number of shares outstanding improves market liquidity, making it easier for investors to buy and sell their股份.

- Positive Market Sentiment: Stock splits are often seen as a sign of company confidence and growth, boosting investor sentiment.

- Potential Price Appreciation: While stock splits do not directly lead to price increases, they can attract new investors, potentially driving demand and price appreciation.

- Tax Implications: Stock splits are non-taxable events, meaning investors do not incur capital gains or losses as a result of the split.

- Long-Term Value Creation: Stock splits align with a company's long-term growth strategy, creating value for shareholders over time.

Balance Sheet Of Tata Motors With Ratio Analysis Financial Statement - Source alayneabrahams.com

In conclusion, Tata Motors' stock split is a strategic move that aims to increase shareholder value and liquidity. By making shares more accessible, enhancing market liquidity, and boosting investor sentiment, the stock split paves the way for long-term value creation for the company and its shareholders.

Tata Group Stocks - List of Tata Group Stocks | 5paisa - Source www.5paisa.com

Tata Motors Stock Split: Boosting Shareholder Value And Liquidity

A stock split is a corporate action in which a company divides its existing shares into a larger number of shares. This is done to make the stock more affordable and accessible to a wider range of investors. In the case of Tata Motors, the stock split was announced in June 2022, with the aim of increasing shareholder value and liquidity.

Tata Motors Share Price Soar After Stellar Q2 Results | Stock Market - Source www.zeebiz.com

The stock split had a positive impact on Tata Motors' share price. In the months following the announcement, the stock price rose by over 20%. This is likely due to the increased demand for the stock from retail investors, who were now able to afford to buy the stock. The stock split also increased the liquidity of the stock, making it easier for investors to buy and sell the stock.

The Tata Motors stock split is a good example of how a company can use a corporate action to boost shareholder value and liquidity. By making the stock more affordable and accessible, the company was able to attract a wider range of investors and increase the liquidity of the stock. This resulted in a positive impact on the share price and the overall value of the company.

The following table provides a summary of the key benefits of a stock split:

| Benefit | Description |

|---|---|

| Increased shareholder value | A stock split can increase shareholder value by making the stock more affordable and accessible to a wider range of investors. |

| Increased liquidity | A stock split can increase the liquidity of a stock by making it easier for investors to buy and sell the stock. |

| Increased demand | A stock split can increase the demand for a stock by making it more affordable and accessible to a wider range of investors. |

Conclusion

A stock split is a corporate action that can have a positive impact on shareholder value and liquidity. By making the stock more affordable and accessible, a company can attract a wider range of investors and increase the liquidity of the stock. This can result in a positive impact on the share price and the overall value of the company.

The Tata Motors stock split is a good example of how a company can use a corporate action to boost shareholder value and liquidity. By making the stock more affordable and accessible, the company was able to attract a wider range of investors and increase the liquidity of the stock. This resulted in a positive impact on the share price and the overall value of the company.