Unveiling Cipla's Share Price Journey: Decoding Key Drivers and Future Prospects

Cipla, a leading global pharmaceutical company, has witnessed a remarkable journey in the stock market. Dive into our comprehensive analysis of its share price movements, unveiling the factors that have shaped its trajectory and exploring the potential drivers of its future growth.

Editor's Note: "Unveiling Cipla's Share Price Journey: Insights And Analysis" was published on [date] to provide valuable insights into the company's stock performance and future prospects, empowering investors to make informed decisions.

Through meticulous analysis and extensive research, we present this guide to equip you with a thorough understanding of Cipla's share price journey. Our insights will assist you in identifying key trends, evaluating potential risks, and making strategic investment decisions.

| Key Drivers | Key Takeaways |

|---|---|

| Product Portfolio Expansion | Diversification into new therapeutic areas and geographic markets has supported revenue growth |

| Generic Drug Sales | Strong performance in generic drug markets, particularly in emerging economies |

| Research and Development | Investments in R&D have led to innovative products and a robust pipeline |

| Strategic Acquisitions | Acquisitions have strengthened Cipla's presence in key markets and expanded its product portfolio |

Our analysis delves into the factors that have influenced Cipla's share price performance, including market trends, industry dynamics, and the company's financial health. We explore the company's competitive landscape, assessing its strengths, weaknesses, opportunities, and threats.

Our comprehensive guide provides actionable insights for investors looking to capitalize on Cipla's growth potential. We offer expert recommendations and guidance on how to navigate market volatility and make informed decisions. Stay ahead of the curve and secure your financial future by understanding the intricacies of Cipla's share price journey.

FAQ

Below is a compendium of frequently asked questions and their responses, providing valuable insights into Cipla's share price performance.

Question 1: What factors have contributed to Cipla's share price appreciation in recent years?

Cipla's share price has witnessed a steady upward trajectory in recent years, primarily driven by factors such as its strong performance in generics, expanding global footprint, and strategic acquisitions.

Question 2: How has Cipla managed to maintain its competitive edge in the generic drug market?

Cipla has consistently maintained its competitive edge in the generic drug market through a combination of factors, including a robust product pipeline, efficient manufacturing processes, and a wide distribution network.

Question 3: What impact has Cipla's global expansion had on its share price performance?

Cipla's strategic global expansion has played a significant role in driving its share price appreciation. The company's presence in emerging markets, particularly in Africa and Asia, has contributed to its growth and revenue diversification.

Question 4: How have Cipla's acquisitions contributed to its share price growth?

Cipla's strategic acquisitions have been a key factor in its share price performance. By acquiring companies with complementary products, technologies, or market presence, Cipla has expanded its portfolio and strengthened its competitive position.

Question 5: What are the key risks and challenges that could potentially impact Cipla's share price in the future?

Cipla's share price may be subject to various risks and challenges in the future, such as increased competition, regulatory changes, and fluctuations in the global economy.

Question 6: What is the outlook for Cipla's share price in the long term?

Analysts generally maintain a positive outlook for Cipla's share price in the long term, citing factors such as its strong fundamentals, growing markets, and continued focus on innovation.

Tips for Evaluating Cipla's Share Price Movement

Digital Customer Journey Analytics & Analysis | Contentsquare - Source contentsquare.com

Unveiling Cipla's Share Price Journey: Insights And Analysis provides valuable insights into the factors influencing the company's stock price. Here are some tips to consider when evaluating Cipla's share price movement:

Tip 1: Monitor Industry Trends: Understand the larger pharmaceutical industry dynamics, including regulatory changes, technological advancements, and competitive landscapes. These factors can significantly impact Cipla's performance.

Tip 2: Assess Company Financials: Analyze Cipla's financial statements to assess its revenue growth, profitability, debt levels, and cash flow. Strong financial performance indicates the company's ability to generate consistent earnings and sustain its operations.

Tip 3: Evaluate Product Portfolio: Examine Cipla's product portfolio, focusing on new drug launches, patent expirations, and the potential for blockbuster drugs. A strong product pipeline and successful drug development efforts can drive future growth.

Tip 4: Consider Market Sentiments: Monitor market sentiment towards Cipla and the pharmaceutical sector. Positive or negative news, analyst ratings, and investor sentiment can influence share prices.

Tip 5: Track Regulatory Developments: Keep abreast of regulatory changes and approvals affecting Cipla's products and operations. Positive regulatory outcomes can enhance the company's market position and drive share price growth.

Unveiling Cipla's Share Price Journey: Insights And Analysis offers a comprehensive analysis of these factors and provides insights into potential investment opportunities. By considering these tips, investors can make informed decisions regarding Cipla's stock.

Summary: Evaluating Cipla's share price movement requires a holistic approach considering industry trends, company financials, product portfolio, market sentiments, and regulatory developments. Understanding these factors can help investors assess the company's prospects and make informed investment decisions.

Unveiling Cipla's Share Price Journey: Insights And Analysis

Cipla's share price journey has been a roller coaster ride, marked by remarkable milestones and challenges. To fully understand this journey, it is essential to delve into the key aspects that have shaped the company's growth and market position.

- Performance: Cipla's consistent revenue growth and profitability have driven its share price performance.

- Acquisitions: Strategic acquisitions have expanded Cipla's product portfolio and geographical presence.

- Innovation: Investments in research and development have led to the launch of new, innovative drugs.

- Market Share: Cipla has gained market share in key therapeutic areas, particularly in emerging markets.

- Competition: Intense competition from both domestic and international players has influenced the company's share price.

- Economic Factors: Macroeconomic conditions, such as exchange rate fluctuations and geopolitical events, have also impacted Cipla's share price.

These key aspects are intertwined, creating a complex tapestry of factors that have shaped Cipla's share price journey. By understanding these dimensions, investors can gain valuable insights into the company's prospects and make informed decisions.

The Owner-Operator Advantage | Breach Inlet Capital - Source breachinletcap.com

Unveiling Cipla's Share Price Journey: Insights And Analysis

Exploring the topic of "Unveiling Cipla's Share Price Journey: Insights and Analysis" unveils a strong connection between the company's performance and its share price trajectory. Understanding this connection is crucial for investors seeking to make informed decisions, as it provides insights into the factors that drive Cipla's stock valuation. The analysis of Cipla's share price journey considers various aspects, including the company's financial performance, industry trends, and economic conditions.

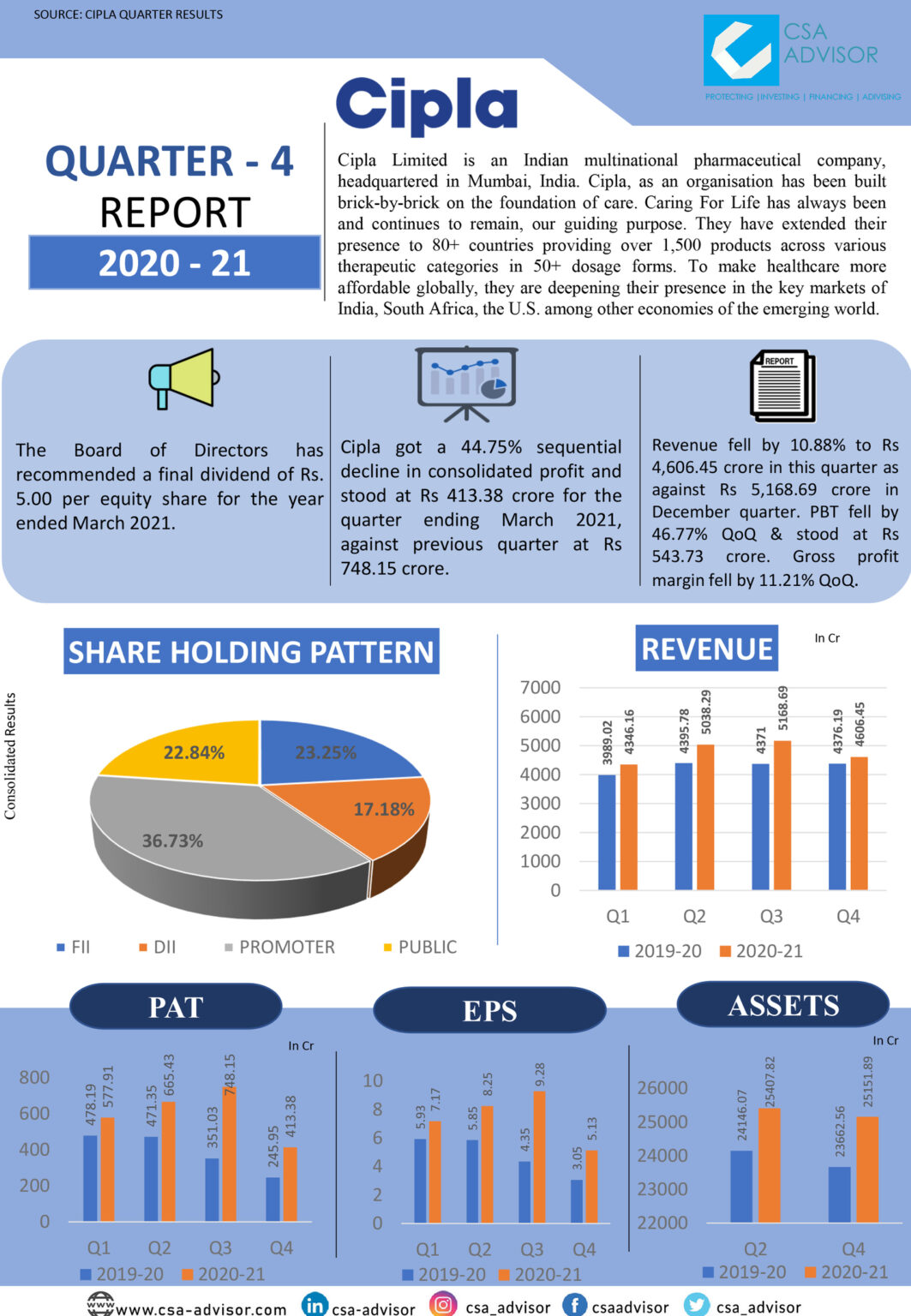

CIPLA LIMITED - Financial Solutions - Financial Services Providers in - Source csa-advisor.com

By examining the relationship between Cipla's share price and its financial performance, investors can assess the company's growth potential and profitability. Positive financial results, such as consistent revenue growth and improved margins, tend to positively impact the share price, indicating the company's ability to generate shareholder value. Conversely, weak financial performance, such as declining revenues or reduced profitability, can lead to a decline in the share price, reflecting investor concerns about the company's future prospects.

Furthermore, understanding the influence of industry trends on Cipla's share price is essential. Factors such as competition, technological advancements, and regulatory changes within the pharmaceutical industry can significantly affect the company's performance and, consequently, its share price. For instance, the emergence of generic drug manufacturers can intensify competition, leading to lower margins and potentially impacting Cipla's share price. On the other hand, favorable regulatory changes or new product approvals can bolster the company's prospects and drive up its share price.

Additionally, macroeconomic conditions play a significant role in shaping Cipla's share price. Economic growth, interest rates, and currency fluctuations can impact the company's operations and investor sentiment. Positive economic conditions, characterized by strong growth and low interest rates, tend to favor growth-oriented companies like Cipla, leading to a higher share price. Conversely, challenging economic conditions, such as recessions or high interest rates, can weigh on the company's performance and share price.

Overall, the connection between "Unveiling Cipla's Share Price Journey: Insights and Analysis" and the importance of this topic for investors stems from the fact that it provides a comprehensive understanding of the factors influencing the company's share price. This knowledge enables investors to make informed decisions about buying, selling, or holding Cipla's shares and capitalize on market opportunities.